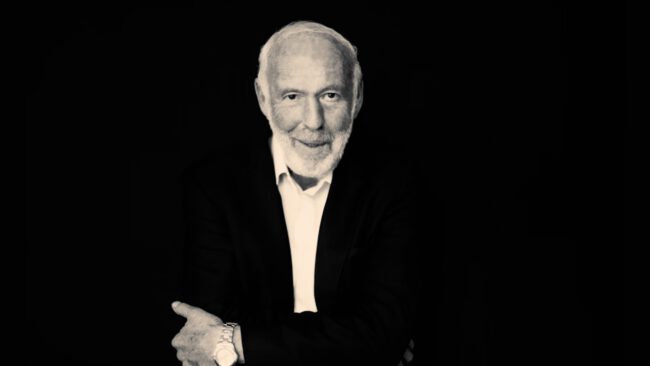

Who was Jim Simons: The Man who solved the market

Today we at Stokex reflect on the passing of Jim Simons, recognizing his impact not just on quantitative finance but also on the broader scientific and educational communities. His approach to problem-solving and investment, which weaved complex mathematical models into the fabric of financial strategy, is one that echoes in our work and informs our…