For decades, the democratic lawmakers in the U.S. have promised to raise taxes on companies and high-income individuals. The motivation to implement this goal was pushed into an overdrive after President Donald Trump signed a tax-cut package excessively benefiting corporations and top earners. Now, with President Joe Biden seated in the White House, the democrats finally have the chance to steer in the largest federal tax increase since 1942.

What will Biden’s $1.9 trillion stimulus package mean for the U.S. dollar in the long run and is the threat of a depreciated dollar looming?

Biden’s tax plan

After the pandemic hit the U.S. full force last year in March, the large volume of monetary and fiscal stimulus introduced since then has helped weaken the US dollar index to 89.20 earlier this year—the lowest it’s ever been so far. So, in theory, Biden’s third stimulus check, that would add $1.9 trillion to the country’s economy, should push the dollar value to even lower numbers.

That said, the tax increase plan put forward by the Biden administration would essentially slow down the lowering dollar positions. Pushing for increased taxes for the corporations and those earning above $400,000, Biden also campaigned to raise the highest individual income tax rate from 37% to 39.6% while upping the corporate tax rate to 28% from the current 21%. This would potentially pay for the third stimulus package and battle the dollar depreciation.

The goal of such a tax increase is, primarily, to cover the third stimulus package price and ensure sustainable servicing of U.S. debt and the receipt of political dividends in the eyes of lower-income citizens. The U.S. might have a chance to set the tone for a massive tax review in other active economies.

Economic repercussions

Tax policies in general have a long-term effect on the economy, rather than an immediate influence. As such, the increased corporate tax would bring serious economic ramifications in the long run. The new corporate taxes would reduce the competitiveness of the U.S. companies on the international stage. Taxes play a role in business decisions on where to invest and expand, so higher taxes on businesses could impact investments by American companies as well as whether foreign businesses would choose to invest in the U.S.

Compared to President Trump’s tax-cut, setting up a business in the U.S. will pay off less than establishing one in emerging and fast-growing markets. This would also affect American workers, especially those with higher incomes, as it could influence migration decisions and create more job opportunities outside the U.S., triggering capital flight from the country.

Any new tax raise is a process that determines economic development and doesn’t necessarily contribute to the rise of the country’s economic prosperity. A balanced approach is needed, without forgetting to assess the tax policies of the competing economies.

Possibilities of the US dollar depreciation/appreciation

The weakening of the dollar doesn’t depend solely on the U.S. monetary policies and the economic progress of the country. It’s also influenced by competing economies and other fiscal processes.

A few key factors that could influence the dollar depreciation comes with the EU economy’s move towards stabilization. The unemployment levels seem to be dropping, foreign direct investments (FDIs) are experiencing an increase and the foreign trade imbalances with the U.S. are growing. As such, the American dollar could be headed for a depreciation against other currencies.

However, it’s more likely than not, that both EU and Japan, as well as other countries, will be forced to raise their taxes for businesses and households alike, so that they could balance out their historical debts.

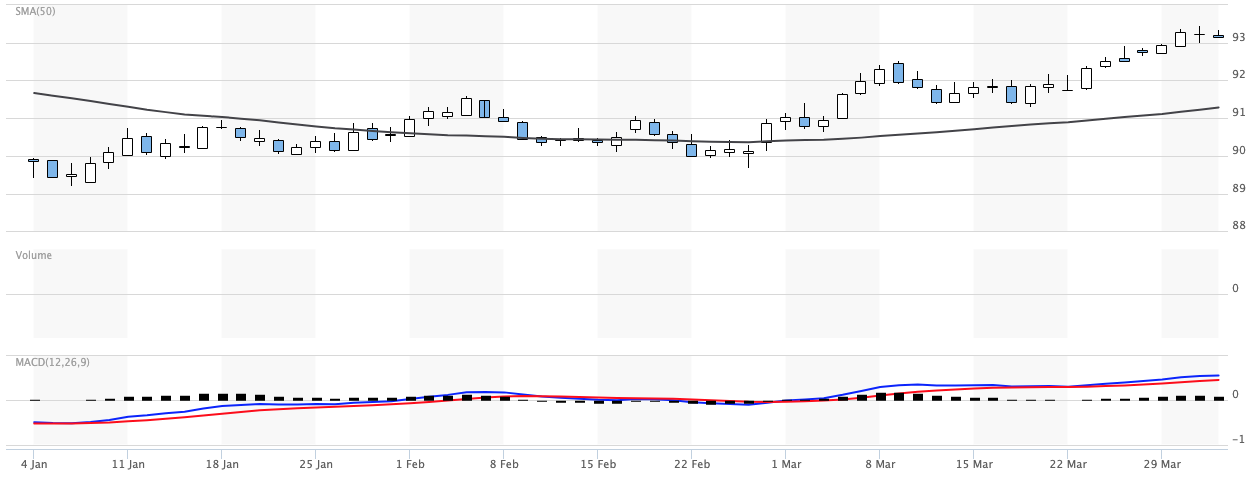

Source: U.S. Dollar Index, MarketWatch

While the US dollar is currently seeing an upward trend from day-to-day timeframe, the first possible signs for the U.S. inflation could appear in the timeframe of 2022 December–2023 June, which will be sufficient for a USD appreciation.

Haltering depreciated currency benefits

A depreciated U.S. dollar has quite a few benefits, including bigger competitiveness of the U.S. economy as exports become cheaper and more competitive to foreign buyers. However, the tax hike for businesses and individuals with high income puts a halter on the appeal of such benefits, here’s why:

Rising imports and consumer prices in the United States are the scourge of the currency depreciation economy. That would cause a chain reaction and spur FED to increase base interest rates in the following 18 to 24 months. This process then would push the dollar to stabilize or even appreciate.

But the increased base interest rates would negatively affect the households as well, as the larger share of the family budget would be given to service the national debt. It’s not that scary as long as the GDP growth is stable and consumer income is growing faster than inflation. A halt in household income growth and inflation remaining on an upward trajectory, however, would inevitably be followed by a short-term or long-term recession, which the politicians seem to have chosen to manage by excessive monetary printing, that way shifting the burden of the public debt service to the future generations.

Wrap Up

At the first glance, President Joe Biden’s proposed tax plan seems to be a good way to combat the major issues: third stimulus package cost, dollar depreciation and the national debt service. However, in the long-term, such a tax hike will have serious ramifications and the first indications of the dollar inflation could be seen as early as 2022 December.